If SBI also dare speak the truth and if SBI shows courage to book all bad assets as NPA , I think it will break all records and book maximum loss and create another history in banking industry. I think loss booked by SBI and total volume of NPA will not be less than aggregate of all PUS banks. It all depends on honesty of banks in identification of assets and recognition of income as per RBI norms.

No power can stop public sector banks moving from bad to worse even in coming years .

Officers from top to bottom at powerful positions are birds of the same feather.They think more for their welfare on priority and less for bank they are associated with.

Unfortunatley and strategically good officers are always posted by these clever top officials at critical places so that their voice is unheard and they loss their stamina to fight against corrupt officials and corrupt politicians.

Politicians add fuel to fire and they leave no stone unturned to damage health of banks..They also think for their vote bank and use banks as milching cow for their family and friends. None of them think for good of Banks. They are more often than not, selfish and corrupt.

NPA as such will continue to rise and rise. Politicians and top bank officials will always make promises to correct the health in forthcoming quarters. They are master in delivery of lectures in seminars and before media. But this will never happen that health of banks will start improving .

We have been witnessing continued deterioration in health of banks for last three decades. Only manipulation and fraudulent methods are used to show banks as shining. Unless and until , purification starts from top and from their heart, I at least cannot imagine of improvement in health of banks or any fall in bad assets in near future .

Respected Sri Vinod Rai will almost fail in its target of cleaning and improving the health of ailing banks in the system he is supposed to work.

While in audit, he used to submit report on sickness, iregularities, frauds and scams. But now he has to rectify them and to stop them which is not as easy as it is visualised by Government of India. . It is a hard nut to crack because political leaders as well as bank officers are concerned more with their career and their position in power and in wealth and least bothered about health of banks and that of economy.

RBI Governor Mr. Raghuram Rajan has been making his best efforts to clean banks. But politicians will not allow him to move as freely as he wishes. Further it is not always good to say spade a spade.

It is also true that It is RBI which failed in discharging its duty to regulate public banks. In seventies and eighties , RBI officials used to inspect branches of various banks and there used to be a fear in the minds of bankers. Since 1991 , in the name of freedom, in the name of reformation , in the name of privatisation and lierlisation , RBI has left everything free and Bhagwan Bharose.

After losing all, RBI has come to senses in last one year or so and only 150 bad accounts pinpointed by RBI has brought almost all banks in red. You may imagine what will happen if all loan accounts are honestly scanned and categorised in appropriate category by bankers. 30 to 40 percent of advances will be found in the category of NPA. And governmnt will be left with only one alternative , that is to provide capital to save its image.

Banks are happy that they buy Certificate of Good Health from Team of Chartered Accountants every year. And Government is Happy that they get certificate of good health of banks from Chief of each bank. Let people of India suffer and taxpayer bear the brunt of their corrupt and ill-motivated moves.

WE did not take lesson from Satyam Computer fraud, from Harshad Mehta or Ketan Parikh scam and neither from ever increasing cases of frauds and misappropriation of bank's fund.

Financials Indicate True Health Of Banks ?

This is my blog written day before yesterday.

Sri Vinod Rai and his team in Bank Board Bureau (BBB) appear to be trying for cleaning balance sheet of public sector banks in particular and banks in general. RBI Governor Mr. Raghuram Rajan has also been engaged in cleaning of finacials of PSU banks for last two years. Prior to that Mr. Suba Rao also tried a lot to clean Balance sheet of PSU banks. Mr. Arun Jaitley Finance Minister and Mr. Jayant Sinha Dy Finance Minister are also sincerely trying their best to improve health of banks. Mr. P Chidambram and Mr. Pranab Mukherjee also appeared to think of best for banks.

But the fact is that no improvement has actually taken place at ground level during last three decades in culture of lending , in position of recovery and in habit of negligence in monitoring in PSU banks. Situation has rather been deteriorating year after after. Top ranked Officers who are clever in manipulating balance sheet come out with shining balance sheet and get elevation through their mentor Ministers and RBI officials. But sooner or the later, in some quarter or the other , each bank has to book bad results and make false promises that they will deal with problems and try to reduce stressed assets in forthcoming quarters.

In fact ,Officials are in general busy in falsely glorifying their bosses. A Branch Manager glorifies a Regional Head, RH glorify Zonal Head , General Managers glorify ED and CMD and finally CMDs are busy in glorifying Finance Ministers and RBI officials. Most of them are fittest Yesman than real performers. They are good speakers to hypnotise ministers and bank staff both. They are more loyal to their sources of wealth and power than to their bank.

Bank Officials take care of their bosses more than thier banks. They are loyal to their bosses and their clients who make them richer and powerful . They in general do not take care of quality of loans they disburse and do not bother of monitoring loans sanctioned by their prdecessors or in matter of recovery of dues from bank loan defaulters. They are more often than not, busy in extending red carpet welcome to their bosses, their CMD, ED and other senior officials to earn their blessings, to cover up their evil works in lending and finally to get quickest promotion and choice transfers . They learn the art of gifting and polishing auditors for getting a certificate of good health of loan accounts in their bank.

Officals who are not apt in flattery and not expert in earning bribe are languishing in insignificant and critical places . Inefficient officials in general are ruling over efficient officials. Inexperienced are ruling over experiened ofgicers. Majority of branches of each Bank is headed by either corrupt officers or inefficient officials or these branches are facing acute shortage of staff or they are working under prssure of higher bosses or local mafiamen. It is always easier for them to compromise quality to survive in the corrupt system than to assert their knowledge and values.

Politicians are busy in boosting up credit growth in all banks by hook or by crook. They want to see rise in credit figures and they are least bothered whether the loans disbursed are going in the hands of good borrowers or bad borrowers. They are not aware whether considerable chunk of loan amount is distributed in officials, middlemen, CAs and political leaders.

Poltiicans in general want to gain political advantage by announcing one after other loan disbursal schemes and loan waiver schemes . They want that each bank and each branch disburse loans and achieve the imposed target .They make new schemes year after year and allow open loot in the name of achievement of targets fixed for various schemes. Quality is not their headache. They care for reserved and not for deserved.

Politicians are not going to understand that every area and every town is not blessed with same potential for growth. They do not agree that each officer of bank do not have same quality and same knowledge. They do not understand that process of loan sanction is a time consuming process in the same way as it is developing love with opposite sex. They are not ready to accept that understanding credentials of loan seekers is not everybody' s cake.

In such situation and in such an environment where majority of officials from top to bottom are busy in flattery and bribery , where administrative and judicial officers are inefficient and corrupt and where politicians are crazy for enrichment of their vote bank , learned , intelligent and talented Sri Vinod Rai cannot hope for success in real cleaning of balance sheet , neither of PSU banks nor that of private banks. There is however no doubt in honest, integrity, sincerity and loyalty of Sri Vinod Rai.

It is remarkable here to say that it is lastly people of India who will have to face the brunt of falling and ailing banks . It is they who will get lesser interest and lesser dividend on their investment in these banks . On the contrary bad borrowers will get more and more loans at lower and lower interest and more and more discount when their loan account is considered as Non Performing Asset by lending bank. Bad borrowers will get more acceptance and good enterpreneurs will face so many hurdles in getting loans from banks .Dream of better GDP growth will get shattered in hands of evil minded care takers.

Vinod Rai and his team and Finance Ministers Mr. Arun Jaitley appears to be convinced that health of banks is not alarming . They are too much positive minded or they are inclined to appear to be positive minded to save country's image and ratings.

They appear to be busy in dealing with bad assets of banks, but in fact slippages increases faster than upgradation of bad assets almost in all banks . Some banks are considered strong banks in their opinion and some other are weaker in comparision. But their ideas and perception about a bank will continue to change and fluctuate from quarter to quarter. Some time bank 'A' will appear to be strong and some other time same bank 'A' will look like weaker.

I howevr observe that banks like PNB, BOB, IOB, OBC, SBI which were considered as strong banks are having the highest volume of bad assets concealed with the help of technology and several tools of restructuring and evergreening and it is their cleverness that they are exosing their bad debts in slow and gradual manner. Banks which were considered weak two to three decades ago are still weak and their weakness has grown in valuecand volume . No sign of improvement is visible in real sense though government has been making efforts for more than three decades.

Fact is that each and every PSU bank is weak and their weakness have been growing relentlessly. Only point to be appreciated is that they are expert in hiding or exposing bad debts. It is completely their whims and fancies which works in taking decision on helath of a loan account. If they like they can conceal a bad accounts for years and treat it as Standard asset . When their evil works goes beyond control or when some of recalcitrant auditors or some of media men expose the hollowness of a company , these bank officials decides to treat a bad asset as bad asset. None of junior officers otherwise have courage to say spade a spade.

Window dressing in deposits, advances and recognition of bad assets has become the deep rooted culture in all banks and regulating agncies have no option other than to accept the inflated , manipulated and fabricated figures. There are many lames excuses like economic recession, global slowdown and natural hurdles to save their skins.

Government will have to do a lot of hard work for years and decades to get rid of sins of past officials and past politiicians who silently and brilliantly looted banks for their self interest and to gain in wealth and power for decades . It is not as easy to clean them as Mr. Vinod Rai and Mr. Arun Jaitley appear to visualise.

It will take very long period in real cleaning of banks and changing of deep rooted culture of bankers and politicians because still GOI and BBB are collecting opinion and views of those officials and politicians who promoted loot and evil culture of flattery and bribery . Thieves and looters cannot disclose their evil ideas to police . They can be good speakers and expert in flattery to bosses . They can be master in managing bosses . But they cannot give valuable ideas which may translate into real transformation and reformation in health of banks.

For real change, Vinod Rai will have to work personally for a bank for years and then only he will be in a position to understnad ground reality. It is easy to make good policies but it is difficult to execute them in true spirit.

For real change, Vinod Rai will have to work personally for a bank for years and then only he will be in a position to understnad ground reality. It is easy to make good policies but it is difficult to execute them in true spirit.

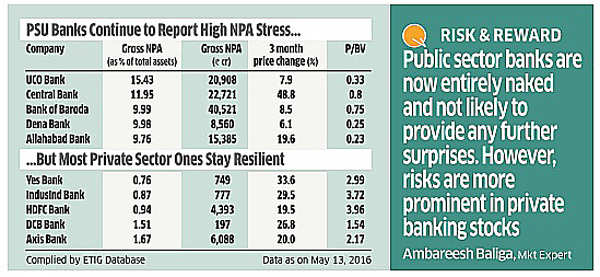

Public sector banks that declared their results till date in general reported quarterly losses. or sharp erosion in profit , as non performing assets (NPAs) continued to pile on after the Reserve Bank of India's (RBI) asset quality review (AQR).

Bank of Baroda, Central Bank of India , Allahabad bank, UCO Bank and Dena Bank reported a loss for the second consecutive quarter. Union Bank of India was the only exception reporting a small net profit in the quarter ended March 2016, though down 78% from a year ago. Bank of Maharashtra and Vijya Bank also reported little profit.

In near future , we will witness more devastating results from other public sector banks. Hollowness of so called strong banks will also be exposed, if they truely stick to strict prudential norms fixed by RBI for identification of assets and for income recognition. Biggest bank is said to be SBI. I hope sooner or the later this bank will also tell the truth of bank .

A day will come when FM and PM as also BBB will accept the truth and then they will take more effective steps to brighten future of banks.

I have full faith in leadership, caliber and talent of Mr Narendra Modi Prime Minister of India and his team associated with the task of cleaning these banks. I have full faith in ability , knowledge,potential and capability of sri Raghuram Rajan rbi governor.

I hope ,sooner or the later, thing will improve because they all are sincerely working on it.

Click Here To Read How CMD And ED are Selected And Officers Are Promoted

Also Read This blog

A day will come when FM and PM as also BBB will accept the truth and then they will take more effective steps to brighten future of banks.

I have full faith in leadership, caliber and talent of Mr Narendra Modi Prime Minister of India and his team associated with the task of cleaning these banks. I have full faith in ability , knowledge,potential and capability of sri Raghuram Rajan rbi governor.

I hope ,sooner or the later, thing will improve because they all are sincerely working on it.

Click Here To Read How CMD And ED are Selected And Officers Are Promoted

Also Read This blog

Bank of Baroda

It posted a loss of Rs 3,230 crores almost repeating its December 2015 performance when it announced a record Rs 3,342 crore loss.

For the full fiscal year ending March 2016, the bank posted a record loss of Rs 5067 crore.

The bank set aside Rs 6,857 crore as provisions, up 3.5 times from the Rs 1,817 crore in March 2015. Provisions included Rs 1,564 crore for pension liabilities and Rs 300 crore for NPAs in the bank's branches in UAE.

Gross NPAs increased to 9.99% from 3.72% and in actual terms crossed the Rs 40,500 crore mark up from Rs 16,261 crore in March 2015.

UCO Bank

For the full fiscal year ending March 2016, the bank posted a record loss of Rs 5067 crore.

The bank set aside Rs 6,857 crore as provisions, up 3.5 times from the Rs 1,817 crore in March 2015. Provisions included Rs 1,564 crore for pension liabilities and Rs 300 crore for NPAs in the bank's branches in UAE.

Gross NPAs increased to 9.99% from 3.72% and in actual terms crossed the Rs 40,500 crore mark up from Rs 16,261 crore in March 2015.

UCO Bank

It reported a record loss of Rs 1,715 crore because of a near 2.5 time rise in provision to cover for NPAs. The loss was higher than the Rs 1,497 crore loss the bank had reported in the preceding quarter.

Gross NPAs of the bank doubled to Rs 20,907 crore from Rs 10,265 crore it reported last fiscal.

Total provisions more than doubled to Rs 2,283 crore compared with Rs 1,018 crore a year ago hitting profit.

This is the second consecutive quarterly loss for the lender after the RBI directed banks to recognise some loans particularly linked to the infrastructure and metal sectors as NPAs.

Allahabad Bank

Bank reported a loss of Rs 581 crore for the March quarter, compared to a profit of 203 crore a year ago as provisions rose to Rs 2,487 crore.

The bank's gross NPA ratio rose to 9.76% from 6.40% in the preceding quarter and 5.46% a year ago. In absolute terms, gross NPAs rose to Rs 15,385 crore at the end of March from 8,358 crore a year back.

Union Bank of India

The bank's gross NPA ratio rose to 9.76% from 6.40% in the preceding quarter and 5.46% a year ago. In absolute terms, gross NPAs rose to Rs 15,385 crore at the end of March from 8,358 crore a year back.

Union Bank of India

This Bank's net profit fell to Rs 97 crore in the quarter ended March 2016 from Rs 443 crore a year ago. However, provision for NPAs increased to Rs 2008 crore from Rs 833 crore a year ago.

Gross non-performing assets (NPAs) rose 85.49% to Rs.24,170.89 crore at the end of the March quarter from Rs.13,030.87 crore a year ago

The bank's gross NPAs rose to 8.7% in March 2016 from 4.96% in March 2015. Net interest income falls 1.71% to Rs2,084.69 crore, gross NPAs rise 85.49% to Rs24,170.89 crore, while provisions jump 55% to Rs1,564.67 crore

Central Bank of India

Bank reported Rs 898.04 crore loss as gross NPAs doubled and provisions rose four times to Rs 2,287 crore from Rs 617 crore a year ago.

Dena Bank

This bank slumped to a loss of Rs 326 crore in the quarter ended March 2016 compared to a net profit of Rs 56 crore a year ago. Gross bad loans almost doubled to Rs 8,560 crore versus 4,393 crore a year ago.

Central Bank of India

Bank reported Rs 898.04 crore loss as gross NPAs doubled and provisions rose four times to Rs 2,287 crore from Rs 617 crore a year ago.

Dena Bank

This bank slumped to a loss of Rs 326 crore in the quarter ended March 2016 compared to a net profit of Rs 56 crore a year ago. Gross bad loans almost doubled to Rs 8,560 crore versus 4,393 crore a year ago.

Vijaya Bank

Bank's Q4 net drops 26% on higher provisioning.

Gross NPAs as a percentage of advances rose to 6.64 per cent from 4.32 per cent in December quarter. Similarly, the net NPA ratio for the March quarter was up 4.61 per cent.

Provisioning during fiscal 2016 rose 62 per cent to Rs 1,390.51 crore from Rs 859.13 crore in the previous year.

For the year-ended March 2016, Vijaya Bank posted a net profit of Rs 381.80 crore, down 13 per cent, over Rs 439.41 crore in the corresponding period last year.

Gross NPAs as a percentage of advances rose to 6.64 per cent from 4.32 per cent in December quarter. Similarly, the net NPA ratio for the March quarter was up 4.61 per cent.

Provisioning during fiscal 2016 rose 62 per cent to Rs 1,390.51 crore from Rs 859.13 crore in the previous year.

For the year-ended March 2016, Vijaya Bank posted a net profit of Rs 381.80 crore, down 13 per cent, over Rs 439.41 crore in the corresponding period last year.

Bank of Maharashtra

Bank's Q4 net loss at Rs119.84 cr.For the entire 2016 fiscal, the bank’s net profit also saw a fall of Rs. 100.69 crore in comparison to Rs. 450.69 crore in the same period previous fiscal. Total income however, stood marginally higher at Rs. 14,072 crore against 13,671 crore in the previous year.

Gross NPAs and net NPAs stood at 9.34 per cent and 6.35 per cent, respectivel. The stressed accounts portfolio declined to 13.29 per cent from 13.47 per cent during the financial year.

Indian Bank

Bank has posted a 59 per cent drop in its net profit to Rs 84.5 crore for the quarter ended March, from Rs 206.1 crore in the corresponding quarter last year.

The bank’s gross non-performing assets (NPAs) rose to Rs 8,827 crore, from Rs 5,670.4 crore.

In percentage terms, it rose to nearly 6.6 per cent, from 4.4 per cent a year ago.

Net NPA rose to Rs 5,419.4 crore from Rs 3,146.9 crore. In percentage terms, it was increased to 4.20 per cent from 2.50 per cent.

Indian Bank

Bank has posted a 59 per cent drop in its net profit to Rs 84.5 crore for the quarter ended March, from Rs 206.1 crore in the corresponding quarter last year.

The bank’s gross non-performing assets (NPAs) rose to Rs 8,827 crore, from Rs 5,670.4 crore.

In percentage terms, it rose to nearly 6.6 per cent, from 4.4 per cent a year ago.

Net NPA rose to Rs 5,419.4 crore from Rs 3,146.9 crore. In percentage terms, it was increased to 4.20 per cent from 2.50 per cent.

Asst quality audit done by RBI in last year only for top 150 accounts has exposed hollowness of almost all public sector banks. Most of them are either in huge loss or have faced huge erosion in profits during the financial year 2015-16. Big jump in Gross Non Peforming Assets have been reported by almost all PSU banks. Halth of private banks is also not as good as reported in public domain.

If all loan accounts are audited by RBI ,one may very well imagine the fate of these banks, one may also understand the gravity of sickness in banks and at least realise now how much Congress party had already damaged during decades of their misrule.

If all loan accounts are audited by RBI ,one may very well imagine the fate of these banks, one may also understand the gravity of sickness in banks and at least realise now how much Congress party had already damaged during decades of their misrule.

Biggst bank ,SBI will declare result on 27th of this month. You may imagine how much painful the result of SBI in fourth quarter will be if they too follow in true spirit the advice given by RBI Governor Mr. Raghuram Rajan regarding asset quality of top 150 accounts audited by them.. I have no doubt that SBI will leave other banks far behind in matter of loss and Gross NPA and break all records of the past.

SBI has delayed maximum in publishing results only because they are perhaps busy in manipulating figures so that damage is reduced to best possible extent. But in the long run, they will also have to come out with correct figures on losses, provisons and NPAs.

Some other banks have also cleverly and fraudulently managed to save their image by making lesser provisions for bad assets and booked little profit fraudulently just to save their falsely brightened career from damage.

Finance Minister Mr. Arun Jaitley and RBI Governor Mr. Rajan are still in dark about real volume of stressed assets . They are unable to visualise the volume of pain hidden in bank's books of accounts. NPA may grow from 5 to 50 percentage if all banks shows true honesty in saying spade a spade, in rcognisiing and identifying bad assets strictly as per RBI prudential norms.. Still they have huge volume of bad and stressed assets hidden in disguise as standard assets so that lesser provision is necessitated..

Clever bankers have been manipulating figures for years and decades. Window dressing is persisting for decades despite all preachings by RBI and MOF . Every quarter they claim that health of their bank will improve from next quarter. But each quarter , health deteriorates only. This has been happening for last five to ten years. FM and RBI will take long time to understand the gound reality.

Let us see when real truth emerges out and when real reasons are identified by Ministry of Finance and by RBI officials and when effective steps are taken to improve quality of banking. Let us see when banks start focusing on their assets including human assets and stop focusing on their bosses and non- banking activities.

Clever and corrupt bankers as well as politicians usually blame economic slowdown or interest rate or nature but never punish real guilty. They say on the one hand that GDP growth of the country is highest in the world. But when they talk of health of banks, they say that bad assets are creation of ecoomic slowdown and global recession. Is it not inconsistent with ground rality.

Until real guilty people are punished and until there is change in culture of bankers and politicians, we should not dream of reformation or real cleaning in banks. We need not focus as much on cleaning of balance sheet as it is needed to focus on cleaning of minds and hearts of bankers, borrowers and politicians.

FM Mr. Arun Jaitley has said yesterday, that media men , opposition parties , Parliamentarians and court should not intervene in banking activities related to lending as well as compromise with recalcitrant and defaulting borrowers.

I would like to mention here that neither media men nor court interferered anytime during last years and decades in the matters related to lending decisions and in decisions related to writing off of bad loans or in arriving at settlment with bad borrowers. Bankers and political leaders are to be held responsible for all lapses and evil works which has resulted in erosion of health of PSU Banks.

Banks have rather enjoyed absolute freedom in sanction of loans and in wirting ff of bad loans. Politicians exrt pressure from top , but they do not burn their fingers by giving written instructions to do this or do that. Political masters advice Chiefs of banks on phone what a bank has to do and what not to do. Similarly bosses of banks give verbal instructions to their subordinates.

I would like to mention here that neither media men nor court interferered anytime during last years and decades in the matters related to lending decisions and in decisions related to writing off of bad loans or in arriving at settlment with bad borrowers. Bankers and political leaders are to be held responsible for all lapses and evil works which has resulted in erosion of health of PSU Banks.

Banks have rather enjoyed absolute freedom in sanction of loans and in wirting ff of bad loans. Politicians exrt pressure from top , but they do not burn their fingers by giving written instructions to do this or do that. Political masters advice Chiefs of banks on phone what a bank has to do and what not to do. Similarly bosses of banks give verbal instructions to their subordinates.

Rather this unregulated freedom given to bankers in the name of reformation and autonomy to bank management in the year 1991 has only resulted in accumulation of so much pain and so much rise in sickness in these banks. Techonologial advancement and introduction of Core Banking Solutin has made it difficult for bankers to conceal their sin for long.

FM cannot understand the real picutre of hidden malady and bad culture of bankers and politicians until he continue to collect the views from same gang of Chiefs of Banks who have contirbuted in increasing pain in these banks. Thieves cannot suggest right and correct ways to police to catch culprits. During last thre decades , every FM has accepted the hidden malady and irregularities in banks but they cleverly ignored the prescribed medicine to cure the sickness. Various committes suggested various ways and means to clean banks , but unfortunatley none of them put into action.

Vinod Rai , head of Bank Board Bureau (BBB) also in last few days has said repeatedly that bank officers should not be questioned how they take lending decisions and how they write off bad loans and how they sacrifice huge amount of money in arriving at settlement with defaulting borrowers . Vinod Rai also perhaps assumes that all bankers are discharging their duties with honesty and sincereity.

Vinod Rai also knows that politiicans of this country are beyond control . He knows that vote bank politics of ruling or opposing parties cannot be stopped. That is why he advices total blindness towards ongoing corrupt culture. Actually our country has witnessed various scams causing loss to the tune of thousand and lacs of crores of rupees to country and hence loss arising due to bad debts amounting to 10 or 20 lac crore by PSU banks appears very small amunt to Mr. Vinod Rai and to government necessitating action against erring officials and politicians.

Vinod Rai also knows that politiicans of this country are beyond control . He knows that vote bank politics of ruling or opposing parties cannot be stopped. That is why he advices total blindness towards ongoing corrupt culture. Actually our country has witnessed various scams causing loss to the tune of thousand and lacs of crores of rupees to country and hence loss arising due to bad debts amounting to 10 or 20 lac crore by PSU banks appears very small amunt to Mr. Vinod Rai and to government necessitating action against erring officials and politicians.

I hope concepetion and perception of learnd, honest, sincere and intelligent person like Mr. Vinod Rai will drasticaly change if he also peeps into accounts of any bank. Only forensic audit of each high value loan account , at least loans and advance with outstanding value more than Rs. one croe, can reveal how much problem is man made and how much is due to unavoidable natural reasons.

If we look into reasons of smaller loans too, the situation will prove to be explosive and suicidal too. Because banks cannot avoid small loans which are equally unsafe and irrecoverable. They know that in the name of social welfare , banks have to lend farmers and small traders and industrialists to inflate figure of priority sector lending .Banks have to take part in charity banking as taught by political masters. Waiver of loan has been resorted to by bankers only at the instance of political masters from time to time and this has adversely affected the repayment culture in the country. Loan Mela culture has also contributed in worsening lending quality and in rise in corruption in banks. Let us therefore concentrate on only high value loans.

Culture of loan melas, culture of write off of loan and culture of protecting bad officials and politiicans has damaged health of banks. To add fuel to fire, regulators also resort to evil ways to cure ailing banks.

FM suggests merger and consolidation of banks. In my view , merger is not at all a solution to problem of bad assets. Merger will simply change the shape of banks and bring its name in list of top banks of the world. But it cannot change the quality of lending and quality of human resources running these banks. It cannot stop politicians exploiting banks for vote bank and it cannot stop them for serving interest of their kith and kin, friends and relatives.

FM talks of consolidation of PSU banks on the one hand and on the other they are giving license to Payment banks, differentiated banks, Post bank and other small banks or big bank . This inconsistency in their policy has created more confusion than eliminating it or reducing it . They are dreaming of big bank by merging smaller banks so that the new enitty may be reckoned in top 100 banks of the world . But the fact is that when management of banks is unable to manage small banks , how will they manage big banks is a million dollar question.

Some of VIPs in government plead for higher packages for executives to make them more loyal . But they do not like to say why government school teachers do not teach though their pay package is greater than that of their counterpart in private schools. Teaching in private schools is far better than that in public schools though government spend huge amount of money on education every year.

FM suggests merger and consolidation of banks. In my view , merger is not at all a solution to problem of bad assets. Merger will simply change the shape of banks and bring its name in list of top banks of the world. But it cannot change the quality of lending and quality of human resources running these banks. It cannot stop politicians exploiting banks for vote bank and it cannot stop them for serving interest of their kith and kin, friends and relatives.

FM talks of consolidation of PSU banks on the one hand and on the other they are giving license to Payment banks, differentiated banks, Post bank and other small banks or big bank . This inconsistency in their policy has created more confusion than eliminating it or reducing it . They are dreaming of big bank by merging smaller banks so that the new enitty may be reckoned in top 100 banks of the world . But the fact is that when management of banks is unable to manage small banks , how will they manage big banks is a million dollar question.

Some of VIPs in government plead for higher packages for executives to make them more loyal . But they do not like to say why government school teachers do not teach though their pay package is greater than that of their counterpart in private schools. Teaching in private schools is far better than that in public schools though government spend huge amount of money on education every year.

FM focus on quality of ED and CMD, but real improvement will occur only when due recognition and value is given to real performers in promotions and transfers. Quality of officers heading branches and administrative offices of banks is too poor to protect banks from disaster.

RBI Governor Mr. Rajan says that one third of ATMs are non-functinal or not managed properly to service requirements of ATM cardeholders. He should try to understand why has it so happened. Mindless and reckless expansion of ATMs and Branches has resulted in pathetic postion of not only ATMs but also branches of various banks.

Banks in public sector has opened branches without applying their brain and without having vision about future of these branches.They open ATM after ATM and branches after branches only to keep ruling party happier and in good stream so that their personal career gets brightened.

Politicians are also responsible for reckless expansion of branches. It is they who for the sake of vote banks built pressure on management of these banks to open branches in each village and then open one ATM associated with each branch. They do not understand or they are least bothered whether these ATMs and Branches will be economically viable or not .

I have no hesitation in saying that not only one third of ATMs , but more than half of branches of PSU banks are critcially ill and non-productive. There are many branches in the country which do not receive transactions from even 50 customers a day, but they have opened one ATM to such branches. Naturally per day hit at these ATMs can never be profitable. Similarly , bank officers do not have time or do not have quality manpower to adequately service these ATMs in time.

Prime root cause behind deteriorating position of health of banks is also its Human Resource Policy and its real execution in practice. Recruitment and Promotion taken place during last three decades has simply promoted a culture of bribery and flattery only. Officers and employees in general who are real performers are neglected and rejected in all processes of transfers and promotions which are said to be merit oritented. This is why majority of senior and experienced staff are not taking part in promotion processes taking place in banks every year.

Bank management use to say that they have scarcity of good workers, it is totally worng and false. Still there are huge number of good officers who do not want to be elevated because they cannot manage flattery and costly gifts for their bosses. They do not want their families to be disturbed due to whimsical decisions of corrupt officers and baseless ruling in their banks. Every employee who joins a banks had high ambition to rise . But the culture of their bosses shatters their dream and they think it safe to avoid taking promotions . Who will change this culture? It will not stop until there is change in mindset of bosses.

Jaitley says that media , Parliamentarians and court should not question decisions of bankers in lending and compromise settlements or in write off.

I fully disagree with his views .

Rather I like to ask Mr.Jaitley whom should we ask questions on why assets with more than 20 lac crores are stressed, why lacs of crores of good money is sacrificed to please defaulters.

Media and courts were in deep slumber till case of Mallya came in public domain and it is only due to their intervention after exposure of Kingfisher default, rightly or wrongly, that government is now appearing as serious to contain sickness of banks and appear to be interested to recover money from at least wilful defaulters declared by banks themselves.

http://importantbankingnews2.blogspot.in/2016/05/do-not-question-bank-officers.html?m=1

Bank chiefs will not be questioned over NPA resolution decisions: Rai---Hindu Business Line

http://www.thehindubusinessline.com/money-and-banking/bank-chiefs-will-not-be-questioned-over-npa-resolution-decisions-rai/article8626679.ece

I fully disagree with his views .

Rather I like to ask Mr.Jaitley whom should we ask questions on why assets with more than 20 lac crores are stressed, why lacs of crores of good money is sacrificed to please defaulters.

Media and courts were in deep slumber till case of Mallya came in public domain and it is only due to their intervention after exposure of Kingfisher default, rightly or wrongly, that government is now appearing as serious to contain sickness of banks and appear to be interested to recover money from at least wilful defaulters declared by banks themselves.

http://importantbankingnews2.blogspot.in/2016/05/do-not-question-bank-officers.html?m=1

Bank chiefs will not be questioned over NPA resolution decisions: Rai---Hindu Business Line

http://www.thehindubusinessline.com/money-and-banking/bank-chiefs-will-not-be-questioned-over-npa-resolution-decisions-rai/article8626679.ece

One in every 3 PSU banks has stressed assets higher than net worth-LiveMint 25.05.2016

In the last six months, 22 state-owned banks reported losses of Rs30,700 crore

Things have gone from bad to worse in India’s banking industry since the central bank cracked the whip on cleaning up their balance sheets. In the last six months, 22 state-owned banks reported losses of Rs.30,700 crore. They also wiped off 16.4% of their net worth.This reduction in net worth affects the already precarious capital position of these banks.

Need to empower banks to deal with non-performing assets: FM Arun Jaitley -

Economic Times 25th May 2016

The reaction of the media, parliamentarians and courts ended up weakening banks, the finance minister said. "Some of us in our bonafide enthusiasm are doing exactly the opposite. The media will make a business loss look like a scam when it is not. MPs will demand 'recall all loans' not realising that economic activity will come to a standstill. And the courts will take over the management of NPAs. Now, as a result of these three factors, we bring unfair pressure on executives of banks who coul ..

Economic Times 25th May 2016

The reaction of the media, parliamentarians and courts ended up weakening banks, the finance minister said. "Some of us in our bonafide enthusiasm are doing exactly the opposite. The media will make a business loss look like a scam when it is not. MPs will demand 'recall all loans' not realising that economic activity will come to a standstill. And the courts will take over the management of NPAs. Now, as a result of these three factors, we bring unfair pressure on executives of banks who coul ..

Read more at:

http://economictimes.indiatimes.com/articleshow/52425065.cms?utm_source=contentofinterest&utm_medium=text&utm_campaign=cppst

http://economictimes.indiatimes.com/articleshow/52425065.cms?utm_source=contentofinterest&utm_medium=text&utm_campaign=cppst

Folowing are few of my blogs written in the past.

There is an old saying that it is easy to market good customers but difficult to sustain them. It is easier to open new branches but difficult to manage existing branches in fruitful and effective way. It is easy to recruit new staff but difficult to make them able and capable to do sound and healthy banking. it is easy to recruit new officers but difficult to keep them in bank for a longer period.

It is easy to keep bosses happy but difficult to customers happy. It is easy to spend money on big bosses on their hospitality but very hard to spend on improvement of customer service and in extension of time bound quality service to customers upto the level of their satisfaction and in delightful manner.And the more important is it is easy to enhance quantity of any element but difficult to enhance quality of them.

It is unfortunate that bankers instead of curing the sick system , instead of removing corrupt officers from top posts, instead of improving Human Resource policy to make it friendly for real performers, instead of accelerating recovery process, instead of providing adequate manpower , instead of strengthening risk management , instead of gearing up skilllevel of loan processing officers , instead of monitoring tools for keeping their asset healthy , instead of saying spade a spade in time and taking corrective action in time against defaulting borrowers or corrupt loaning officers ------------------------------------------------

Bankers always blame interest rate for worsening asset quality or blaming global recession for rise in bad debts or requesting RBI to reduce Repo rate , reduce CRR or pay interest on CRR to earn profit.

Bankers always blame interest rate for worsening asset quality or blaming global recession for rise in bad debts or requesting RBI to reduce Repo rate , reduce CRR or pay interest on CRR to earn profit.

http://importantbankingnews.blogspot.in/2013/11/top-banks-are-top-in-bad-debts.html

http://economictimes.indiatimes.com/wealth/invest/banking-sector-more-bad-news-expected/articleshow/52372316.cms

Board Bureau chief Vinod Rai says it's time for mergers

Vinod Rai, the veteran bureaucrat appointed this year to run the new Banks Board Bureau, told Reuters the government stood ready to inject fresh funds beyond the USD 3.7 billion earmarked in the 2016/17 Budget.

Jaitley to meet public sector bank chiefs on June 6

Great information all in one place. I am new to blogging and having a blast. This blog is very informative for a new blogger.

ReplyDeletehttp://www.mashupcorner.com/