dna special: They have money, but won't repay - Corporate biggies gobble up Rs23,802cr loans

Wednesday, Sep 4, 2013, 11:40 IST | Place: New Delhi | Agency: DNA

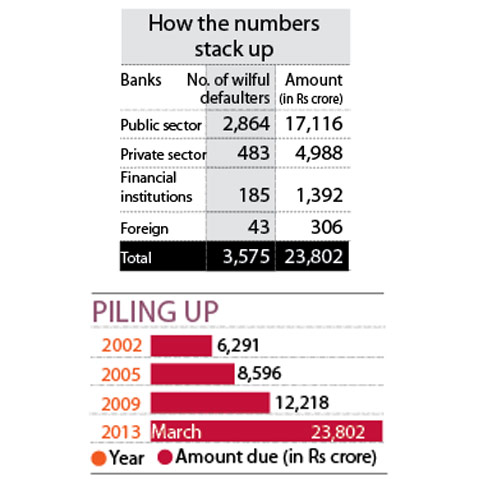

Thousands of individuals and companies have defrauded banks by defaulting on their loans, totalling Rs23,802 crore, even though they have the money to settle their dues.

Amount in question is enough to fund the country’s mid-day meal scheme for two years

As on March this year, 3,575 companies and individuals, who have taken loans of Rs25 lakh or more, were declared ‘wilful defaulters’ for not repaying their loans despite having adequate money, according to information obtained from the Credit Information Bureau India Limited (CIBIL), a banks-promoted agency for managing information of defaulters.

Maharashtra tops the list, with 737 companies and individuals owing about Rs7,000 crore to various public and private sector banks. On its heels are West Bengal and Andhra Pradesh, with dues of Rs2,080 crore and Rs1,980 crore, respectively.

A borrower who fails to repay a loan despite having the capacity to do so or diverts the money or siphons it off is declared a wilful defaulter. A borrower is declared wilful defaulter only after many rounds of consultations and negotiations. The bank gives details of wilful defaulters to the Reserve Bank of India every three months.

Nationalised banks bear the brunt of such frauds. A total of 72% of the money corporates defaulted on were borrowed from these. State Bank of India alone has to recover Rs9,580 crore 41% of the total dues of all wilful defaulters.

“Huge amounts are siphoned off by big corporates every year from the hard-earned profits of banks,” claims Vishwas Utagi, secretary of the All-India Bank Employees Association. “Banks only initiate court proceedings against small defaulters. Why are the names of big defaulters not published?”

Some of the biggies that figure on CIBIL’s list are Hyderabad-based Deccan Chronicle Holdings Limited (Rs342 crore), Surat-based JB Diamonds Limited (Rs314 crore) and Chennai-based Paramount Airways Private Limited (Rs139 crore). Other well-known companies such as ITC Agrotech Limited (Rs2.08 crore) and Ruia Cotex Limited (Rs2.9 crore), a Ruia Group company, have also defaulted on their loan payments.

While most companies failed to respond to queries, ITC Agrotech Limited claimed that it does not have any “outstanding” due.

A spokesperson from the Ruia Group said the company has been “wrongfully” declared a wilful defaulter. “The company challenged it before the debt recovery tribunal, where it succeeded, and the bank’s revision petition in the Calcutta high court was also dismissed,” says Dhrubajyoti Nandi, vice-president, Corporate Communications, Ruia Group.

The amount mentioned here only refers to those cases in which the banks have initiated court proceedings for recovery of dues.

“In several cases, banks do not even report the dues to the CIBIL due to political pressure and a nexus between bankers and officials of defaulters,” alleges Rajesh Goyal, a former banker with a leading nationalised bank who now runs an independent, banking watchdog website — www.allbankingsolutions.com

The rate at which these corporates have managed to swallow public money is phenomenal. While in 2002, the dues of wilful defaulters were Rs6,291 crore, it grew four-fold over the next 10 years to Rs23,802 crore (see box 2).

Wilful Defaulters – RBI Guidelines for Banks

by

Rajesh Goyal

Who is A Wilful Defaulter :

A "wilful default" would be deemed to have occurred if any of the following events is noted:-

(a) The unit has defaulted in meeting its payment / repayment obligations to the lender even when it has the capacity to honour the said obligations.

(b) The unit has defaulted in meeting its payment / repayment obligations to the lender and has not utilised the finance from the lender for the specific purposes for which finance was availed of but has diverted the funds for other purposes.

(c) The unit has defaulted in meeting its payment / repayment obligations to the lender and has siphoned off the funds so that the funds have not been utilised for the specific purpose for which finance was availed of, nor are the funds available with the unit in the form of other assets.

(d) The unit has defaulted in meeting its payment / repayment obligations to the lender and has also disposed off or removed the movable fixed assets or immovable property given by him or it for the purpose of securing a term loan without the knowledge of the bank/lender.

Limit for Reporting Purposes :

The above indicates that there is no minimum amount to declare a borrower as willful defaulter. However, for reporting purposes RBI has set certain limits.

(a) All cases of wilful default (non-suit filed accounts) with outstanding of Rs.25 lakh & above are required to be reported to RBI on quarterly basis as per the format given in the Master Circular on the subject;

(b) All cases of willful default (suit filed accounts) with outstanding of Rs 25 lakh & above are required to be reported to CIBIL. [It may also be mentioned here that banks also submit the suit-filed accounts of Rs. 1 Crore and above to CIBIL i.e. the cases not categorized as willful defaults]

Both the above lists are also sent to SEBI so as to prevent the access to the capital markets by the willful defaulters.

Banks and FIs need not report cases where outstanding amount falls below Rs.25 lakh and cases where banks have agreed for a compromise settlement and the borrower has fully paid the compromised amount.

Banks and FIs are required to take suitable steps to report the names of current directors as also the directors who were associated with the company at the time the account was classified as defaulter to put other banks and FIs on guard. The names of independent and nominee directors are also be included with suitable distinguishing remarks as applicable.

Penal measures

The following measures are required to be initiated by the banks and FIs against the wilful defaulters as per RBI guidelines:

a) No additional facilities should be granted by any bank / FI to the listed wilful defaulters. In addition, the entrepreneurs / promoters of companies where banks / FIs have identified siphoning / diversion of funds, misrepresentation, falsification of accounts and fraudulent transactions should be debarred from institutional finance from the scheduled commercial banks, Development Financial Institutions, Government owned NBFCs, investment institutions etc. for floating new ventures for a period of 5 years from the date the name of the wilful defaulter is published in the list of wilful defaulters by the RBI.

b) The legal process, wherever warranted, against the borrowers / guarantors and foreclosure of recovery of dues should be initiated expeditiously.The lenders may initiate criminal proceedings against wilful defaulters, wherever necessary.

c) Wherever possible, the banks and FIs should adopt a proactive approach for a change of management of the wilfully defaulting borrower unit.

d) A covenant in the loan agreements, with the companies in which the banks / notified FIs have significant stake, should be incorporated by the banks/ FIs to the effect that the borrowing company should not induct a person who is a promoter or director on the Board of a company which has been identified as a wilful defaulter.

In Kotak Mahindra Bank Ltd v. Hindustan National Glass & Ind. Ltd. [2012]

Supreme Court has held that the Master Circular on willful defaults covers not only wilful defaults of dues by a borrower to the bank but also covers wilful defaults of dues by a client of the bank under other banking transactions such as bank guarantees and derivative transactions

|

Grievances Redressal Mechanism

Decisions to classify the borrower as wilful defaulter should be entrusted to a Committee of higher functionaries headed by the Executive Director and consisting of two GMs/DGMs as

decided by the Board of the concerned bank/FI with a view to have more objectivity in identifying cases of wilful default.

The borrower should be suitably advised about the proposal to classify him as a wilful defaulter along with reasons therefore. He should be provided reasonable time (say 15 days) for making representation against such decision to a Grievance Redressal Committee headed by the CMD and consisting of two other senior officials.

He should also be given a hearing in case he represents that he has been wrongly classified as wilful defaulter and a final declaration as ‘wilful defaulter’ should be made after a view is taken by the Committee on the representation and the borrower should be suitably advised.

No comments:

Post a Comment