It is always heard in media that banks are likely to recruit thousands and lac of staff . Sometimes they claim to have employed thousands of bank staff.

But the bitter truth is that number of total bank staff in public sector has sharply come down during last fifteen years i.e. from 883000 in 1998-99 to 716000 in 2010-11 i.e 20 percent fall in 12 years.

Though number of branches in all banks has at least doubled and volume of business has grown by at least 20 times.

Can we not say that banks are showing profit only by exploitation of bank staff and union leaders are silent spectator of all this tortures of bank staff and worsening of health of bank staff and their families?

Can't we say that this has become possible only because union leaders have become second line of management?

Can't we say now without any hesitation that rise in bad assets in public sector bank and fall in profitability is due to dirtiest and corrupt execution of best Human Resource Management policy framed by every bank management and due to large scale flattery and bribery prevalent in banks?

Can't we say now without any hesitation that top bankers in public sector banks raped meritorious staff and extended all best support and all promotions to corrupt and flatter officers only and similarly top bank officials in nexus with corrupt team of IBPS officials recruited only poor quality staff and that too only for personal gain?

Can't we say now that Finance Minister and officials of RBI and that of Ministry of Finance also ignored the corruption of top officials like ED and CMD because they also picked up officers for the post of ED and CMD only by taking bribe and costly gifts ?

Can't we say now that IBPS was constituted by corrupt bankers who continued the same brand of corrupt rule which they did during their service life and this is why quality of staff recruited is worse than what used to be two decades ago?

Can't we conclude now that bank staff are being exploited by top bankers in collusion with union leaders, ministers, politicians and corporate houses only for their personal gain?

And if it is so, why not CBI investigation is necessary into all recruitment and promotions taken place during last 15 or 20 years in the name of reformation and merit oriented recruitment and promotions.

When banks recruited staff and promoted staff on the basis of merit , why banks are sick now?

Are regulators and Ministry of finance birds of the same feather?

When majority of politicians,

elected representative and ministers are thieves, looters and corrupt, they

will never allow any police officials, CBI or CVC or Court to take cognizance

of their crime and to punish them for their crimes. This is why Congress Party

has decided to call all party meeting to decide that political parties should

be kept out of preview of Right to Information Act. This is why CVC or Chief Vigilance

officer s or CBI officials are not allowed to prosecute any minister or senior

government officer even if CBI catch them red handed in cases of corruption. This

is Indian Democracy. And this is called Supremacy of Parliament.

When thieves are chooser of

police officials, CBI officials, CVOs, judges etc, one cannot dream that India

will ever be free of corruption. Cases

against ministers and powerful officials and politicians are not decided in

courts even in a time period of two or three or four decades. This is why politicians

and minister always say that they believe on orders of court. They know that

judges are in their clutch and hence judges may be motivated to decide the case as dictated by their mentor politicians.

And if as exceptional case,

some judges give order against corrupt ministers and politicians, they set a

committee of politicians who are experts in awarding favourable observations

and conclusions. All thieves in political domain are united as far their own existence

and reign of corruption is concerned.

Public sector banks fear losing good talent to new banks--This is an article published in reputed newspaper Business Standard

Public Sector Banks (PSBs), already facing a talent crunch, are set to lose some of their most talented people to the new private banks, scouting for the best brains to run their business. The biggest exodus might be seen at the middle and lower levels, due to better remuneration and career prospects.

The biggest exodus might be seen at the middle and lower levels, due to better remuneration and career prospects.

Though the first licence might not come up before the end of this financial year, as the Reserve Bank of India (RBI) received applications from 26 players barely a fortnight ago, PSBs are already getting the jitters.

Some disgruntled executives from government banks and financial institutions are also banking upon the new banks to give a new lease of life to their career.

"Already there is a talent crunch for PSBs and new banks will take away their best manpower. If you look at the best credit team of some leading private sector lenders today, it is from government banks," admitted a government official, who did not want to be identified.

It is not the sheer number of people leaving for greener pastures that will pinch the government banks.

A few private banks might not be able to make much of a difference to PSBs, with a workforce of about 800,000.

More than attrition, it is the quality of manpower that is worrying them. It could pinch small and mid-size PSBs harder as compared to their bigger peers, as their employees get lesser perks.

By rough estimates, a minimum of six to eight people will be required per branch in rural areas and 10-12 in metros by these new banks, while their head office might have about 100 people.

"As their model would be technology-based, these banks might not need too many people for their branches. The issue is that all competent people of government banks would leave. Poaching will mainly happen at the level of assistant general manager, deputy general manager, and general manager. These positions will almost get empty," said a former executive of a state-run bank.

All public and private banks put together have a little over one million employees today, of which 470,000 are in the officer rank, 402,521 are clerks and about 178,000 are subordinates.

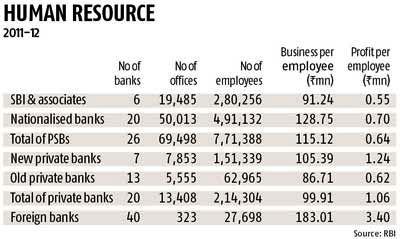

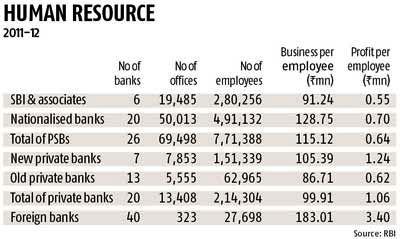

PSBs are facing a shortage at all levels and are criticised often for not doing succession planning in advance. The profit they make per employee is much less than private sector players.

A substantial part of the current workforce in PSBs had joined in the 1970s. In a report in 2010, the Khandewal committee, set up by the government to look into human resources issues in banks, had said over the following two-and-a-half years, about 80 per cent of the employees at general manager level would retire.

The picture it painted for deputy general manager and assistant general manager rank was not rosy either, with 65 per cent and 58 per cent employees projected to be reaching superannuation in the near future, respectively.

One way of averting the crisis to some extent is upgrading the skills of existing staff and training them for bigger roles, and also getting more people and training them.

The issue, however, say bankers, is that there are not enough employable people in the market.

In March, State Bank of India had received 1.7 million applications for just 1,500 probationary officers, but not all were employable.

"When we conduct interviews for a probationary officer, not many fit the bill. But we have to manage with whatever is available," said a senior executive with a state-owned bank. Though there is no dearth of training institutions for bank personnel in the country today, bankers say it is not possible to upgrade skills of people beyond an extent.

Though there is no dearth of training institutions for bank personnel in the country today, bankers say it is not possible to upgrade skills of people beyond an extent.

"Training capacity is there. But you can train and skill people to the level they can perform," said the ministry official quoted above.

PSBs plan to hire 50,000 people and open 10,000 branches in the current financial year, against 63,000 in 2012-13.

The Institute of Banking Personnel Selection, an autonomous body, is engaged in recruitment of personnel and internal promotion in banks and financial institutions.

It conducts a common entrance test for recruiting employees for all PSBs.

Staff strength of PSBs decreased from 883,000 employees in 1998-99 to 757,000 in 2010-11.

Over these years, the cost per employee increased from Rs 167,000 to Rs 716,000, respectively.

The staff of private sector banks, on the other hand, has increased from 60,777 to 218,679 during these years, while their cost per employee went up from Rs 169,000 to Rs 563,000.

http://www.business-standard.com/article/finance/psbs-could-lose-some-good-talent-to-new-banks-113071900021_1.html

The biggest exodus might be seen at the middle and lower levels, due to better remuneration and career prospects.

The biggest exodus might be seen at the middle and lower levels, due to better remuneration and career prospects.Though the first licence might not come up before the end of this financial year, as the Reserve Bank of India (RBI) received applications from 26 players barely a fortnight ago, PSBs are already getting the jitters.

Some disgruntled executives from government banks and financial institutions are also banking upon the new banks to give a new lease of life to their career.

"Already there is a talent crunch for PSBs and new banks will take away their best manpower. If you look at the best credit team of some leading private sector lenders today, it is from government banks," admitted a government official, who did not want to be identified.

It is not the sheer number of people leaving for greener pastures that will pinch the government banks.

A few private banks might not be able to make much of a difference to PSBs, with a workforce of about 800,000.

More than attrition, it is the quality of manpower that is worrying them. It could pinch small and mid-size PSBs harder as compared to their bigger peers, as their employees get lesser perks.

By rough estimates, a minimum of six to eight people will be required per branch in rural areas and 10-12 in metros by these new banks, while their head office might have about 100 people.

"As their model would be technology-based, these banks might not need too many people for their branches. The issue is that all competent people of government banks would leave. Poaching will mainly happen at the level of assistant general manager, deputy general manager, and general manager. These positions will almost get empty," said a former executive of a state-run bank.

All public and private banks put together have a little over one million employees today, of which 470,000 are in the officer rank, 402,521 are clerks and about 178,000 are subordinates.

PSBs are facing a shortage at all levels and are criticised often for not doing succession planning in advance. The profit they make per employee is much less than private sector players.

A substantial part of the current workforce in PSBs had joined in the 1970s. In a report in 2010, the Khandewal committee, set up by the government to look into human resources issues in banks, had said over the following two-and-a-half years, about 80 per cent of the employees at general manager level would retire.

The picture it painted for deputy general manager and assistant general manager rank was not rosy either, with 65 per cent and 58 per cent employees projected to be reaching superannuation in the near future, respectively.

One way of averting the crisis to some extent is upgrading the skills of existing staff and training them for bigger roles, and also getting more people and training them.

The issue, however, say bankers, is that there are not enough employable people in the market.

In March, State Bank of India had received 1.7 million applications for just 1,500 probationary officers, but not all were employable.

"When we conduct interviews for a probationary officer, not many fit the bill. But we have to manage with whatever is available," said a senior executive with a state-owned bank.

Though there is no dearth of training institutions for bank personnel in the country today, bankers say it is not possible to upgrade skills of people beyond an extent.

Though there is no dearth of training institutions for bank personnel in the country today, bankers say it is not possible to upgrade skills of people beyond an extent."Training capacity is there. But you can train and skill people to the level they can perform," said the ministry official quoted above.

PSBs plan to hire 50,000 people and open 10,000 branches in the current financial year, against 63,000 in 2012-13.

The Institute of Banking Personnel Selection, an autonomous body, is engaged in recruitment of personnel and internal promotion in banks and financial institutions.

It conducts a common entrance test for recruiting employees for all PSBs.

Staff strength of PSBs decreased from 883,000 employees in 1998-99 to 757,000 in 2010-11.

Over these years, the cost per employee increased from Rs 167,000 to Rs 716,000, respectively.

The staff of private sector banks, on the other hand, has increased from 60,777 to 218,679 during these years, while their cost per employee went up from Rs 169,000 to Rs 563,000.

http://www.business-standard.com/article/finance/psbs-could-lose-some-good-talent-to-new-banks-113071900021_1.html

http://www.rediff.com/business/report/public-sector-banks-fear-losing-good-talent-to-new-banks/20130719.htm

No comments:

Post a Comment