Then the process will rev up, with lakhs of bank employees guessing and seeing wildest of dreams.

What will be achieved is uncertain but what we have lost in the last two Bipartite should be borne in the mind during this negotiation.

The prestige of Bank Job has been eroded almost completely in the last 10 years. Attrition rate is very high, the situation has come to such that the young intelligentsia are no longer inclined to join banks.

The prestige of Bank Job has been eroded almost completely in the last 10 years. Attrition rate is very high, the situation has come to such that the young intelligentsia are no longer inclined to join banks.

Bitten by pangs of joblessness, some join these banks, only to develop cold feet seeing the things going on within and then look for greener pastures.

Time has come for a revival of the Prestige of Bank Job, time has come to ARREST the ATTRITION and ATTRACT the best and the brightest of talent to join the Bank Service, time has come to save the prestige of Indian Banking particularly the Nationalized Banks, time has come for restoring the GLORY of Nationalized Banks.

The recommendations of 6th Central Pay Commission has been implemented by the Govt. The 6th CPC has completely rationalized the pay and allowances which has resulted in handsome increase across all categories.

Time has come for a revival of the Prestige of Bank Job, time has come to ARREST the ATTRITION and ATTRACT the best and the brightest of talent to join the Bank Service, time has come to save the prestige of Indian Banking particularly the Nationalized Banks, time has come for restoring the GLORY of Nationalized Banks.

The recommendations of 6th Central Pay Commission has been implemented by the Govt. The 6th CPC has completely rationalized the pay and allowances which has resulted in handsome increase across all categories.

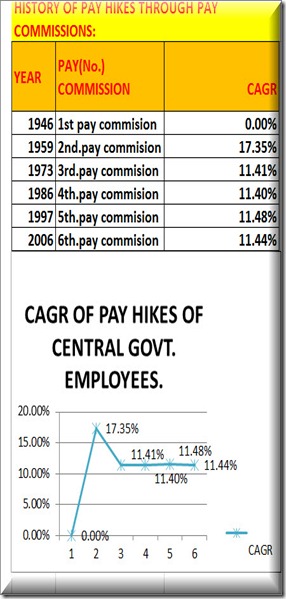

The process of rationalization of salary structure of central government employees, started with 1st pay commission, reached it’s zenith in 6th pay commission, while, since 7th bipartite the disparity vis a vis bank employees, started to widen.

The process of rationalization of salary structure of central government employees, started with 1st pay commission, reached it’s zenith in 6th pay commission, while, since 7th bipartite the disparity vis a vis bank employees, started to widen.

While submitting the recommendation the 6th CPC opined- “While proposing these changes, the Commission has also kept in view the capacity of the Government to pay and the principle that every rupee spent on allowances, facilities and salaries of Government employees has to translate into a specific measure for public good…The Report will, therefore, not only increase the pay and allowances of Government employees but will also prove beneficial for all the people in the country.” Very true, since, these result in:

- Increased spending, thus widening demand and markets for myriad of commodities and encouraging ‘demand push’ widening of productive capacities within the country.

- A contented workforce, resulting in better performance at workplace.

But, in case of pay revision of bank employees, the situation turned utterly depressing with passing time and successive bipartite settlements.

See, how the situation turned so grim that a comparison, as given below, appears to be give ‘creaky hearts’ to bank employees:

Comparative salary for April, 2010 payables to govt. employees as per VIth Pay Commission and to bank officers under 9th Bipartite Settlement between BankUnions and IBA

(Amt. in Rs.)

Heads

|

Group A Officers

Of Govt. of India

(Rs.)

|

Bank

Officers

(Rs.)

|

Basic Pay

|

15600

|

14500

|

Grade Pay

|

5400

|

Nil

|

Special Pay

|

nil

|

Nil

|

Dearness Allowance

|

7350 (35%)

|

5329 (36.75%)

|

H.R.A.

|

6300 (30%)

|

1233 (8.5%)

|

C.C.A.

|

Nil

|

435 (3% Max.540)

|

Education Allowance (Rs.1000/= per child max for 2 children)

|

2000

|

Nil

|

Transport Allowance

|

4320 (3200+35% DA )

|

Nil

|

Gross Monthly salary

|

40970

|

21497

|

****(In the above, past data taken to illustrate the stark differences)

Thus, I earnestly request to all concerned that Paradigm Shift in the approach to wage negotiation is required. Whatever may be the strategy for the current wage negotiation, we must get at par salary vis-à-vis Central Civil PSUs.

Some argue that, comparisons with salaries of bank employees vis a vis central government employees is just not feasible in view of the disparity in intervals between pay revisions in bank employees and central government employees.

So, we tried to do the comparison through another tool of modern finance ie.CAGR(compounded annual growth rate), which smoothens the disparity in tenure/intervals between two types of pay revision exercises.

PAY GROWTH RATE FOR:

CENTRAL GOVT. BANK EMPLOYEES.

**** Note:CAGR calculated by taking the rate of increase in minimum salary across bipartite/pay commissions, into consideration, by the formula:

(((New pay/old pay at the inception)^period between two hikes)-1)*100.

Now, it can be seen from the above graphical representations, theCAGR(compounded annual growth rate) of pay revisions of central government employees, after an initial steep rise, held the ground steady, while the dismal CAGR in case of bank employees, started to dip down from the 7th bipartite and reached ‘nadir’ with 9th bipartite.

Here, only the rate of growth of basic pay is considered, barring that, central government employees get many other perks like housing, education etc. which are not compared for simplicity of the comparison exercise.

If all the benefits given to central government employees like, dynamic pension etc. are factored in, then, the balance will not only tilt but, it will be more appropriate to say, will get skewed in favour of central government employees.

So, ‘musings of life’ just request all the participants of 10th bipartite pay revision exercise , ‘let us strive to bring the shine on banking job back, so that, it again buzz into activity, making forays into newer vistas, with all those talented young professionals at the steering wheel to bring the nimbus around the banking sector of the country back.

Let us remember the great quote that:

“The lack of money is the root of all evil”.Mark Twain

Posted by: Himadri Shekhar Bhattacharjee.

http://www.mitalismusings.blogspot.in/2012/12/monitoring-10th-bipartitepart-i-our.html

No comments:

Post a Comment